Grow your business

How to read a Balance Sheet in 2023?

What is a balance sheet?

The balance sheet along with an income statement are the two things most widely used by investors to determine the company’s financial wellbeing.

Let’s start by taling about what is a balance sheet? A balance sheet is a probably the most core accounting report that is used to assess the company’s financial health at a given time. It shows the company’s assets, liabilities, and shareholder equity at a specific point in time. In simple words, the definition of a balance sheet is report that shows what you own (assets), what you owe (liabilities), and what you invested (equity). These three components make up the balance sheet.

We will understand each of these in more detail below.

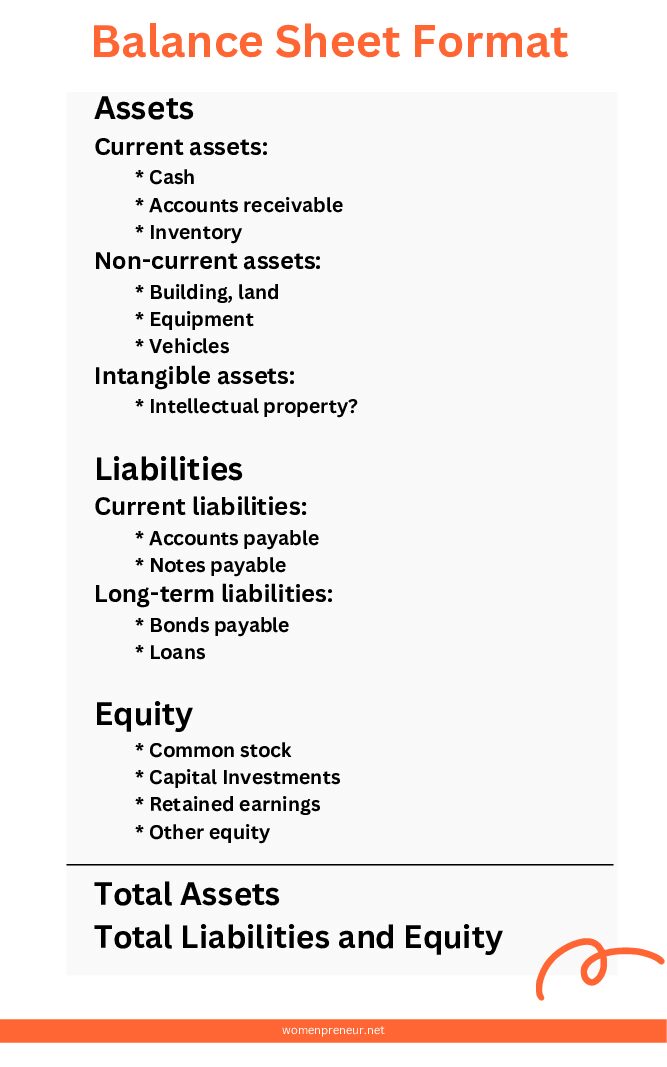

- Assets: This section on the balance sheet shows the resources owned by the company and could include any of the following – cash, amounts owed to the company by other parties, inventory, real estate, vehicles, and equipment.

- Liabilities: This section on the balance sheet shows lists what the company owes others such as the company’s debts, notes payable, and any long-term debts.

- Equity: This shows the amount of money that the owners have invested into the business plus the money that the business makes. This section represents the company’s net worth, which is the difference between assets and liabilities.

What does a balance sheet show?

The balance sheet shows a company’s financial position at a specific point in time. It is a valuable tool for investors, creditors, and other stakeholders and provides snapshot of a company’s financial health at a specific point in time. Investors can use the balance sheet to assess a company’s liquidity, solvency, and profitability. Creditors can use the balance sheet to determine a company’s ability to repay its debts. The balance sheet is a valuable tool for understanding a company’s financial health. It is important to understand how to read and interpret a balance sheet in order to make informed investment decisions.

What is the format for balance sheet?

The format of a balance sheet is dependent on the company and their accounting standards. There are some basic elements that are typically included in a balance sheet.

There are two main sections in a balance sheet: Assets and Liabilities.

The assets section is typically listed in order of liquidity, with the most liquid assets listed first. Liquid assets are those that can be easily converted into cash.

The liabilities section is typically listed in order of maturity, with the most immediate liabilities listed first.

Below is the general format of a balance sheet.

Why should you care about the Balance Sheet?

There are some important equations that can be calculated using a balance sheet which can help you understand the business’s financial performance.

Current Ratio:

Formula: Current Assets / Current Liabilities

This provides the company’s financial health at a given moment. It is obtained by dividing company’s current assets by it’s current liabilities. Usually this ratio is used to determine a company ‘s ability to pay any short term debts.

Current ratio greater than 1 indicates the assets are greater than the liabilities, which in turn indicates that the business has funds to pay the debts.

If the current ratio is less than 1, indicates the current liabilities of the business exceed the current assets which means the company does not have adequate funds for any near term obligations or debts.

Net Worth:

Formula: Net Worth = Assets – Liabilities

Net worth is another measure for financial health. It is calculated by subtracting liabilities from assets. The net worth shows the amount of ownership of the business by the owners as it removes any liabilities that the business has.

Surveys can be a gold mine of information if they are done right. When designing a marketing survey, it is important to consider the following aspects and components:

Each of the above requires careful planning to ensure you are approaching the process the right way. The target audience could be current customers, potential customers, or industry experts. The distribution method is another aspect that requires some planning as you could potentially reach your audience via several channels and you have to determine which one is most efficient.

Difference between Balance sheet & Income statement

There are several differences between a balance sheet and an income statement. Both reports have distinct purpose and convey different information regarding a business’s financial health.

As discussed above, balance sheet provides a snapshot into company’s finances at a given moment in time where as Income statement provides company’s financial performance over a period of time. The information summarized in balance sheets is assets, liabilities and equity where the information reported in an income statement is revenue, expense, gross profit, net profit or loss.

Summary

Now that you have the basics of a balance sheet, you should be able to generate one for your business and assess the financial performance of your business. Note that it is always highly recommended to take the help of a professional CPA to assess a business’s financials.