Grow your business

The complete list of affordable employee benefits solutions for small business

Why are employee benefits important?

Offering benefits is one of the most effective ways of ensuring employee retention and is critical to the growth of your small business. There’s a reason why search volumes in Google are extremely high for phrases such as “employee benefits amazon” or “employee benefits target” or “employee benefits in google” as benefits is an important consideration for candidates when applying for jobs. While these are big companies and have extensive resources, every small business employer should also strive to provide the best possible benefits solutions to their employees. Offering competitive salaries and great employee benefits solutions can be a major game changer for small businesses. Check out our blog on analyzing competitive salary via Indeed Analytics to determine what your competitors are offering their employees.

As many of us women entrepreneurs already know, larger corporations have more options and are able to afford various types of employee benefits, it is often not the same for small businesses. Even when business owners have the best of intentions at hand for their employees, they are often faced with hard choices of high costs of benefit plans, small profit margins and few affordable options available in the marketplace.

When we purchased my business from the previous business owner, there was no concept of benefits for employees. Our fellow business owners advised us that they had researched this at length and found no affordable options which allow you to offer meaningful benefits to your employees and be profitable at the same time. After few years of continuing status quo, we realized that we had a constant challenge with employee turnover. And we really had no employee retention strategy. We were offering our employees competitive pay, but that was it. On doing some in-depth research in this area we realized that there’s so much more to employee satisfaction and retention than the base salary.

Empoyee Surveys and Retention

One of our big learnings in this space was that we didn’t know how happy or unhappy our employees were until we asked them. We also learnt quickly that just asking doesn’t get you all the answers. There are employees who are not very forthcoming or some that are just shy. It was then that we started doing surveys for employee satisfaction. Our staff is bilingual so we created employee satisfaction surveys in English and Spanish languages. Here’s a Survey template you can download for free.

We had good participation rate for the first survey, which was a great start. We discovered a lot of things that was on our employees’ minds, for example – they preferred driving company cars instead of their own cars even though we offered mileage reimbursement. They prioritized the culture of the company and the bonding with their team mates as an important consideration for job satisfaction. Very close to these two items was benefits. They provided feedback that they would like to get benefits from the company.

Benefits is a very vast area and there are so many things to consider. This set us on the path to take on the challenge of figuring out how we can offer our employees benefits and still keep our small business profitable. Read on and we will share our journey, the challenges we faced along the way and the wins. As a reference point for you, we own a service business with twenty employees, so you are looking at a small sized franchise business with mostly hourly paid employees and few salaried employees.

Affordable Employee Benefits Solutions:

There are several different types of benefits: mandatory ones and non-mandatory. Mandatory benefits are ones that all businesses have to provide such as Unemployment Insurance, Overtime Pay, Social Security and Medicare amongst others. What we will be focusing on here are the non-mandatory benefits as this is what will help you compete with the other small businesses in your industry segment.

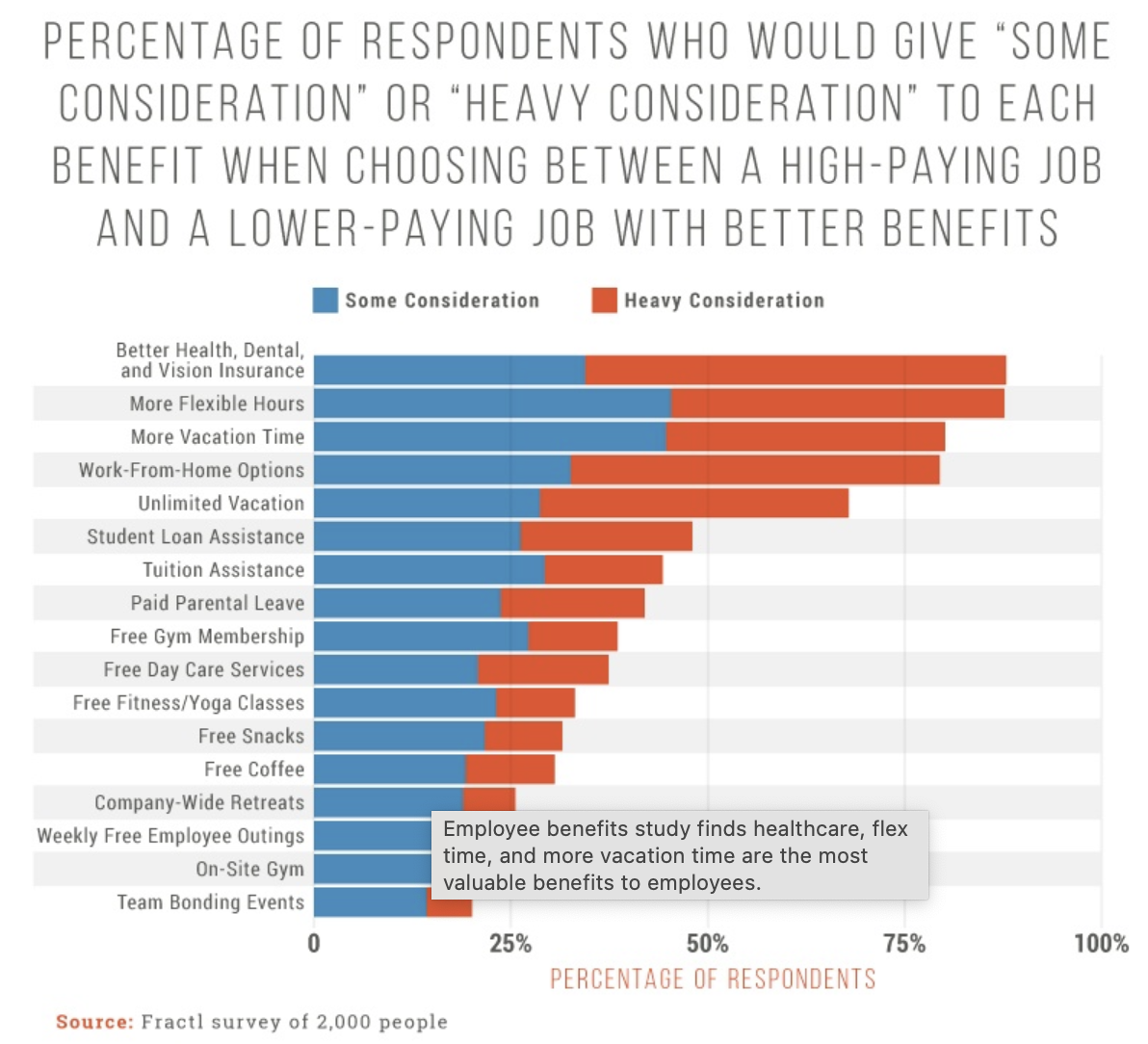

When it comes to non mandatory benefits, there are several ones you can consider for your business. Offering some key non-mandatory benefits can make or break how you perform from employee satisfaction and retention standpoint. Benefits like this will not only help attract great talent, but also retain them. We found this study done by Fractl especially insightful. Their research provides in depth view into the benefits employees seek the most

Source: Study performed by Frac.tl on the Cost and Value of Employee Perks.

1. Health Benefits

Needless to say health benefits coverage tops the list. The number of small businesses offering health coverage has increased vastly over the years. While the bitter fact remains that the health care costs are going up at an exponential rate, business owners are also seeking ways of ensuring they provide some health benefits to their employees where possible.

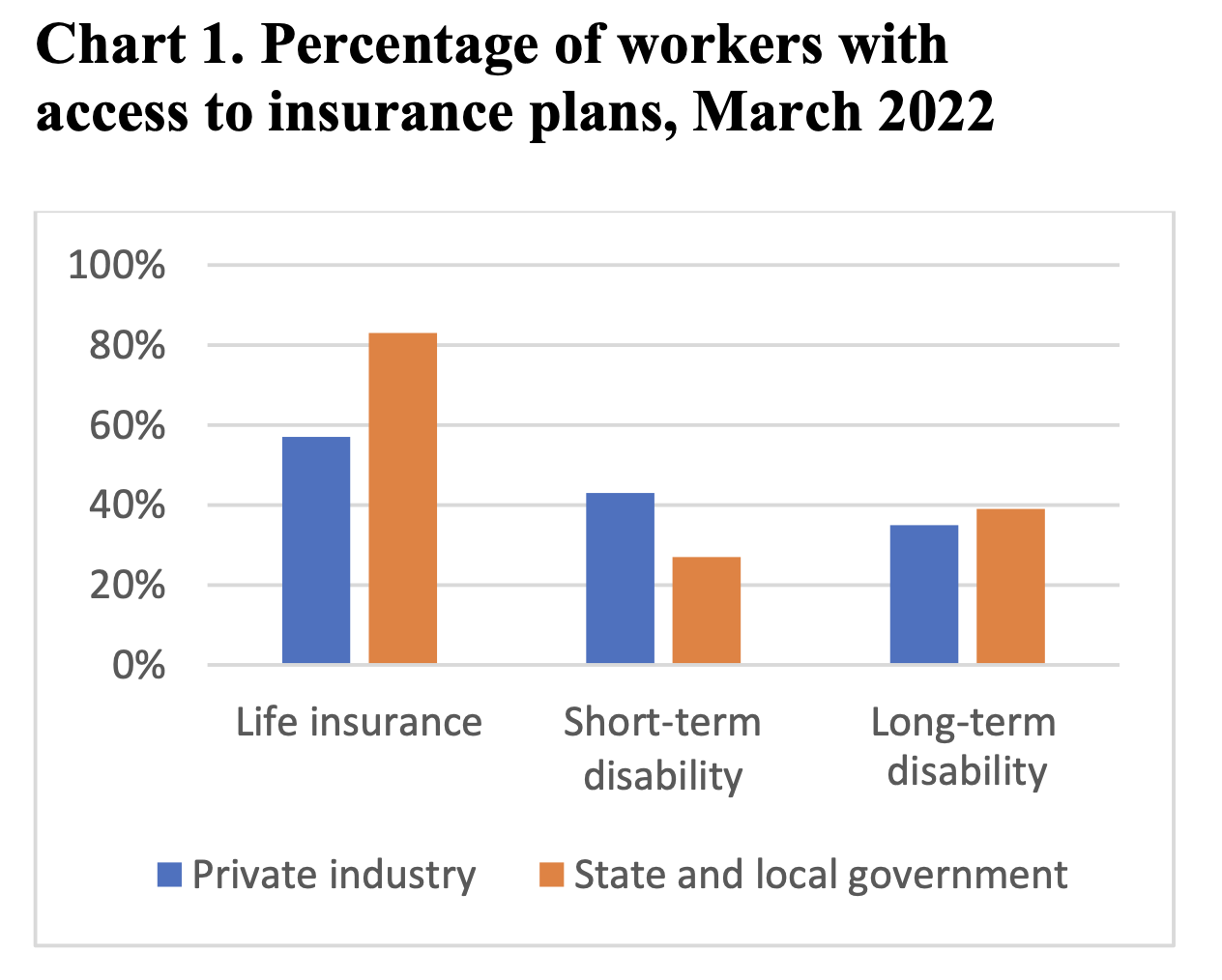

Per the National Compensation Survey Employee Benefits Study published by Bureau of Labor Statistics, it is evident that more and more number of smaller employers (< 50 employees) are now offering health benefits to their employees.

Source of chart: National Compensation Survey Employee Benefits Study published by Bureau of Labor Statistics

There are several healthcare options available to smaller employers. We have listed the ones that are most relevant to small business owners to explore without breaking the bank:

A) Group Health Insurance:

One of the most conventional choices for employers in general, these are usually plans chosen by the employer to provide health coverage for the employees. Employers pay a fixed percentage of premium with a minimum of 50% while employees pay the remaining % of the premium. Employers have the choice of covering 100% of the premium if they so choose and can also decide if they want to contribute towards employees dependents. Employees have to pay for doctor visit copays and deductibles for the medical services to use. Popular group health insurance plans include HMO (Health Maintenance Organization) Plans and PPO (Preferred Provider Organization) plans.

Some things to keep in mind with Group Health Insurance are they usually require a certain set percentage of employee participation and can get very expensive very quickly for the business.

B) HRA plans such as QSE HRA, ICHRA and GCHRA:

These are very popular with smaller businesses, with QSEHRA being the one on the top of the list. HRA are Health Reimbursement Arrangement Plans which small employers can sign up for. Each of these have different eligibility requirements, and employers can choose which one is best suited for their employees. Essentially these involve employers setting an allowance limit for healthcare related expenses and when employees submit proof of expense, employers reimburse the employees based on their allowance limit. There is extensive paper work involved but employers can choose to use a health plan provider offering HRA plans or manage this via their payroll software.

C) Supplemental Health Insurance:

While these are not a replacement for traditional health insurance plans, they serve as good additional insurance to fill gaps and help pay for out of pocket expenses such as health insurance deductibles, co-payments or for specific care such as critical illness, accident or hospital insurance. Employers can choose to contribute a certain amount towards employee premiums which will help offset the costs for their employees.

No matter which route you go, there are tax benefits associated with each plan.

2. Retirement Plan:

Another highly sought after benefit by small business employees is the Retirement Plan or a small business 401 K plan. Any small business employer looking to improve employee retention should consider offering some form of Retirement plan that will allow their employees to save for their future. There are many retirement programs that can provide tax advantages to both employers and employees. Some great ones to look at for small business include SEP IRA and SIMPLE IRA. Eligible employers may be able to claim a tax credit of up to $5,000, for three years, for the ordinary and necessary costs of starting a SEP, SIMPLE IRA or qualified plan (like a 401(k) plan.) A tax credit reduces the amount of taxes you may owe on a dollar-for-dollar basis. Check out this IRS page which lists out the tax credits for employers.

3. Holiday Pay

Paid Holidays is a very popular benefit with employees! Who does not enjoy spending time with their family on holidays, and getting paid on those days only means that their employer supports their well deserved time with family. Each small business can decide which days the company will recognize as holidays. Some of the main ones are noted below:

-

New Year’s Day

-

Martin Luther King Jr Day

-

Memorial Day

-

Independence Day

-

Labor Day

-

Thanksgiving Day

-

Christmas

When holidays fall on the weekend, it is not uncommon for businesses to offer a preceding Friday or following Monday as the holiday. A great practice at the start of the year is to create the holiday calendar and put it in the break room so employees have an early heads up and can plan their vacations well in advance.

4. Paid Leave or Paid Time-off

Paid leave is a no-brainer when it comes to benefits that small businesses can offer to their employees. Paid leave can be of many types:

-

Vacation

-

Sick / Medical leave

-

Personal

-

Bereavement

-

Jury Duty (can be a mandatory paid leave for salaried exempt employees)

-

Family leave / Parental leave

When creating the Paid Time off policy for your company, there are some key considerations to keep in mind such as eligibility, accrual and administration or tracking of the leave. Also note that while federal laws do not require an employer to provide leave benefits to all employees, there could be other state laws in play that you should check about with your labor attorney. A general rule of thumb could be that you offer different leave structure for different employees as long as you treat “similarly situated employees” equally.

5. Workers Comp

Worker’s Compensation is a type of insurance provided by business owners which protects employers from the liability if their employees are injured at the work place or performing their work at work-sites or customer locations. Workers Comp provides coverage for employee salary, medical and rehab bills when the employee has to miss work due to work place accidents. In many states business owners are required to carry workers compensation but that is not true for all states. Whether or not your state requires it, offering workers comp will definitely give you, your employees and the customers the peace of mind of knowing that should an accident happen, everyone is covered.

6. Disability Insurance

While workers compensation provides insurance for work related disabilities, Disability Insurance provides income in case the employee is unable to work due to illness or injury that occurred away from work. There are three key types of Disability Insurance depending on the duration of the disability and other factors: Short Term Disability, Long Term Disability and Social Security Disability Insurance. Aside from offering Disability Insurance, many small business owners also offer Life Insurance as part of their Benefits package. Premiums paid towards Life Insurance policies can have tax advantages such as qualifying as tax deductible.

7. Tuition Assistance

Often also referred to as Education benefit, employers can choose to contribute set amount towards employees tuition reimbursements. For organizations offering this benefit, usually employees pay for the courses and apply for reimbursement once the course is completed. The employer can define the pre-conditions and parameters for education assistance.

8. Child Care Benefits

Employers can sponsor or contribute towards employees’ child care arrangements. Providing child care support is an excellent way of showing how much you value your employees and their familial needs. This could be done in several ways. For example some employees will welcome contributions towards their child care costs while others may need flexibility in schedule to accomodate their high schoolers extracurricular activities. As mentioned at the start of this article, assessing employee needs via a survey is a great starting point.

9. Fringe Benefits:

Aside from the above listed few benefits, there are several other fringe benefits that small business owners and women entrepreneurs can offer their employees which go a long way with increasing employee retention.

Some additional fringe benefits are noted below:

-

Free Snacks & Coffee

-

Company sponsored weekly breakfasts or pizza lunches

-

Flexible hours

-

Some paid hours where employees can volunteer for a non-profit of their choice

-

Quarterly team events

To summarize, I would say that there’s so much that can be done in this space and your goal as a small business owner and a woman entrepreneur should be to focus on researching and finding benefit solutions that allow you to better the lives of your employees and keep your business profitable. A win-win situation.