PLAN & START

Step by Step Guide for Starting a New Business

I can cite several benefits to starting your business, but what I want to talk about here is starting your business while still working full-time. If you are new to the world of entrepreneurship, one of the safest ways of getting started with a business is while you are still working full-time and have the safety net of a regular income coming in.

So, if it is so rosy and easy, why isn’t everyone doing it? The reason is simple. It takes time. It takes grit. It takes patience. Not everyone has these and not everyone is willing to work towards these. There is no reason to wait any longer if you are ready to put in the effort. Here are 5 reasons for starting that side business now and not waiting until you retire or quit your full-time job.

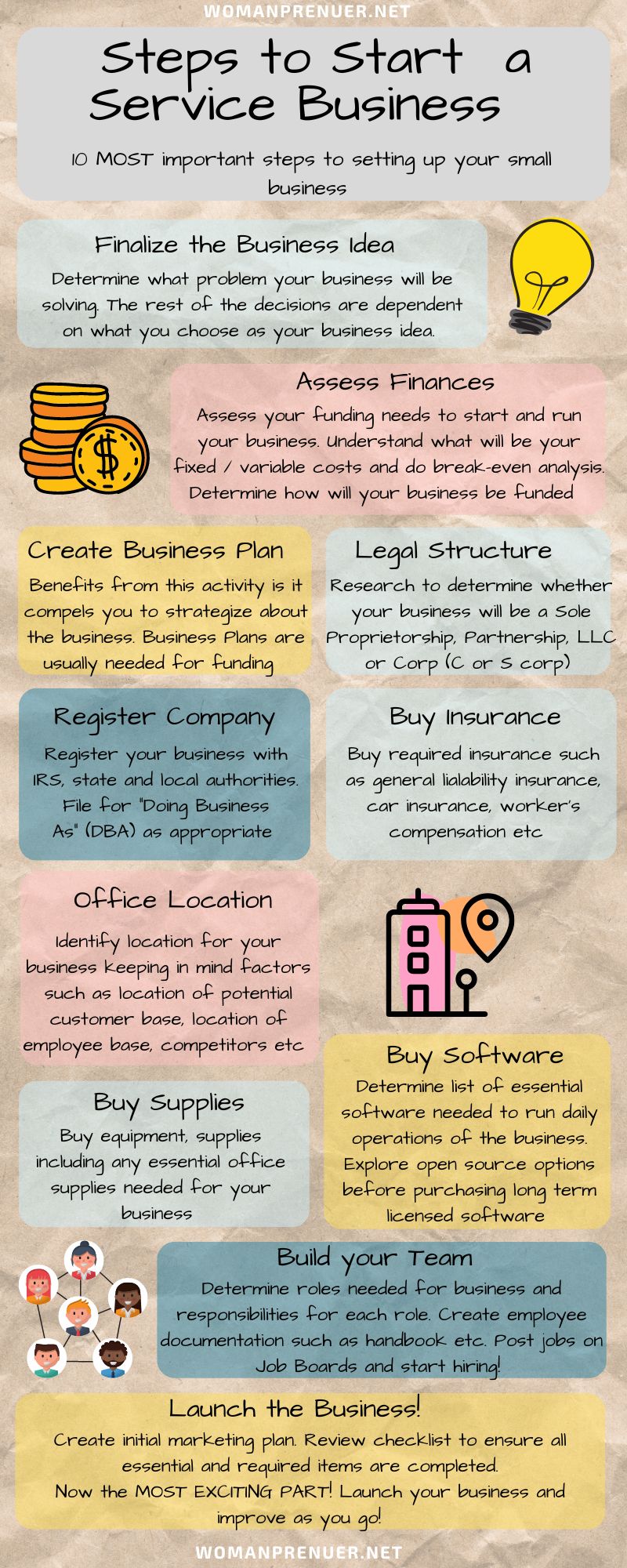

Step by Step Guide

Step 1: Decide which business you want to start

Market Research & Target Audience:

Mission Statement:

Name of the business:

Step 2: Assessing your Finances

Determine Costs:

-

Rent for office space

-

Utilities (electricity, gas, phone service, utilities, internet to name a few). Some of these could be categorized as Variable costs based on usage

-

Software licenses and subscriptions

-

Salaries for full-time employees

-

Insurance

-

Interest for the loan (if applicable)

-

Office supplies

-

Operating supplies, tools, and equipment

-

Wages and commissions (as applicable)

-

Credit Card fees

-

Marketing costs

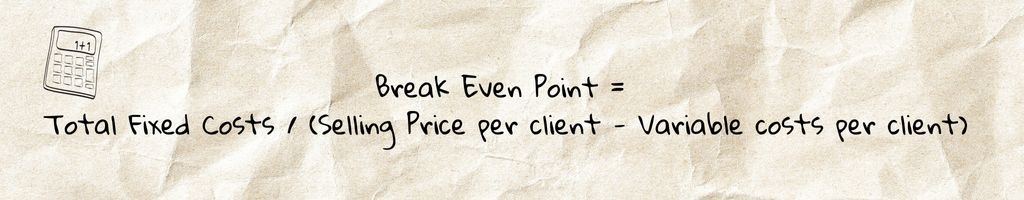

Break-Even Analysis:

Funding the Business:

-

Self-funded / bootstrapping: Use your personal savings and revenue from your initial sales

-

Business loan: These are usually commercial loans through a bank

-

Business grants: These are similar to loans with the exception that they do not need to be paid back. As you would expect, these are also harder to get and way more competitive and may come with specific preconditions that the business might need to meet

-

Angel Investors and Venture Capitalists

-

Crowdsourcing: This involves raising smaller amounts of funds from supporters for your business

Step 3: Create a Business Plan

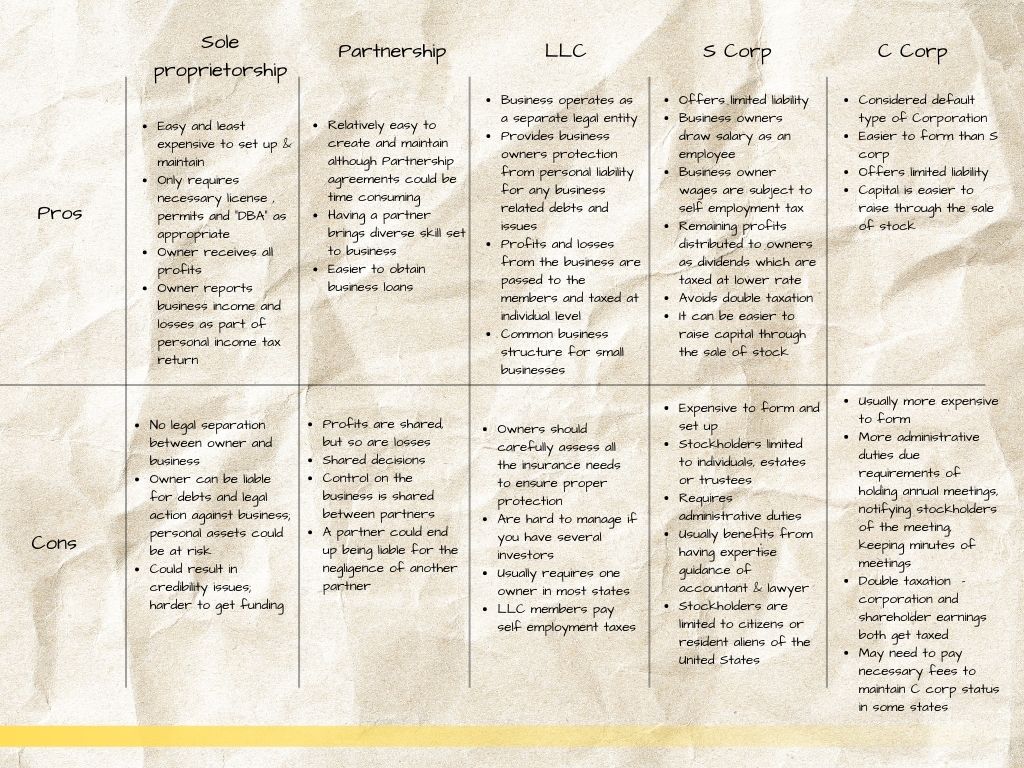

Step 4: Determine legal structure

-

Sole proprietorship: Simplest of the legal structures and involves one individual who is responsible for daily operations of the business. The business and owner exist as one entity. It is inexpensive to set up

-

Partnership: This type of legal structure comprises two or more individuals sharing ownership of the business. Similar to sole proprietorship, the owners and the business are treated as one entity.

-

Corporation: With this legal structure, the business is a separate legal entity from its owner(s). There are two main types of corporations: S corp and C corp. S corp is typically owned by shareholders and is taxed as separate entities. S corp on the other hand is more ideally designed for small businesses and also helps avoid double taxation.

-

Limited Liability Corporation (LLC): Think of this as a hybrid business structure that combines the best of both worlds, I.e., partnerships and corporations. combination of sole proprietorship/ partnership and corporation but it limits the liability to those involved

Step 5: Register the company

Step 6: Purchase Insurance

-

General Liability Insurance which covers property damage and bodily injury to yourself or others

-

Business Income Insurance: This type of insurance usually covers lost income due to fire, theft, and other reasons covered by the policy

-

Workers Compensation: An important one to consider especially if you have employees. This type of insurance provides benefits to your employees if there are any work-related injuries

-

Auto Insurance: If you plan to have business operated cars, you will want to purchase auto insurance which would cover your employees when they drive the car for business-related reasons

Step 7: Select office location

-

Location of your customers: Since you are selling some type of service to customers, it will likely require either the customers to visit your location or you would need to go to the customer’s homes. In either case, you should look up the demographics of the geographic location and ensure your office is located close to your target market.

-

Location of your employees: This is probably the most important of all considerations. Ideally, you want to make sure you are centrally located for most of your employees. If your employees have to drive hours to get to their work every morning, they will soon want to change jobs.

-

Evaluate local zoning laws and taxes to ensure they are favorable and allow for the business type you are looking to set up

-

Parking considerations: Depending on the type of business, are you expecting customers or employees who will require parking. While not always possible, it is ideal to get an office space with at least some dedicated parking spaces.

-

Location of your competitors: It is good to be aware of where your competitors are located, what type of traffic they attract

-

Cost of Rent: Another extremely important consideration. It is important to be very clear on the square footage requirements for your facility. Rent a space that you need, nothing too big nor too small. It is a helpful exercise to map out on a paper what your office layout should look like:

-

How many office rooms would you need

-

Do you need a reception area?

-

Supplies Room

-

Do you need a Huddle / Meeting room?

-

Kitchen and break room?

-

Do you need space for Utilities (washer/dryer etc)?

-

Any specific requirements (big machines or equipment etc)

Step 8: Purchase equipment / supplies

Step 9: Set up software and licenses

An important thing to remember is that there is always a cheaper alternative to any tool that you have to purchase, and by cheaper alternative, I mean being creative and using open source solutions such as Google Sheets and Google Suite. As your business grows, you can invest in upgrading your software.

Main ones to set up:

-

Website: This is probably the most important one. There are several website builders that allow you to build a website for free. Alternately, you can hire a web design team to build a website. It is a good idea to have the site Search Engine optimized (SEO) from the start. Your website is the very first impression you will make on a potential client. Ensuring your site reflects your personality as a business owner, the personality of your business and employees, and does justice to the services you provide is critical.

-

Customer Relationship Management (CRM): There are several powerful CRM solutions in the market, so you have a plethora of options to pick from. A CRM software allows you to have all information about your customers, their work orders, employees, and business performance in one place.

-

Payroll Processor: There are several companies that offer extremely intuitive tools for running payroll and managing tax information. Having payroll processing software is a huge timesaver and many of these Payroll Processor tools provide excellent reporting capabilities.

-

Scheduling Software: These could either be part of your CRM software or a separate one. If your CRM can also help with scheduling appointments, that is ideal since you would then have everything in one place. Oh, I should probably clarify. Scheduling can become tedious and expensive very quickly if you have several customers being serviced by several employees on a recurring basis. Your standard calendar will not cut it and you will need a smarter tool that can schedule multiple customers and generate reporting when needed.

-

Bookkeeping and Accounting: These can be done managed via spreadsheets or you could purchase a license to software to manage your books which is what I would recommend.

-

Software specific to the business: These are software needed for your specific business type. For example, a graphic design business would probably need to purchase the license for Photoshop or a landscaping company may want to purchase a design software that allows them to draft landscaping design

Step 10: Build your team

Launch your Services business